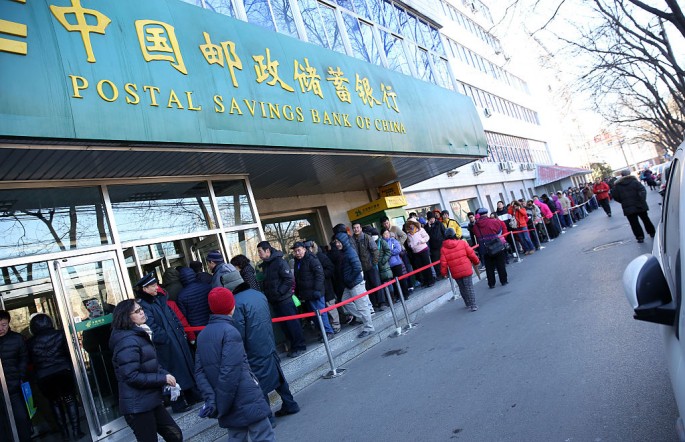

China's Postal Saving Bank is close to getting the $2 billion worth of shares pledged by China State Shipbuilding Corp. in its planned $7 billion-plus initial public offering (IPO), considered to be the world's biggest IPO this year, the Wall Street Journal reported.

People familiar with the matter said that the commitment, including those of other state-owned enterprises, is one of Postal Savings Bank's "cornerstone" investments as the company plans to go public by the end of September.

The two Chinese firms' investment deal shows how money flows in China wherein Hong Kong serves as the gateway that links Chinese companies with capital from global investors. At present, Chinese local firms are financing other Chinese companies for their Hong Kong listing.

Over the past years, it has become common practice in Hong Kong IPOs to allow cornerstone investments, in which investors buy stocks at the offering price and keep them for a period of six months. The practice allows marquee investors to attract others such as sovereign-wealth funds and tycoons to sign up for an IPO.

But since Hong Kong's stock market fell in June last years, bankers rely mainly on companies from the mainland for cornerstone commitments to make sure that their IPOs on the Hong Kong exchange will succeed.

According to private sources, about 60 percent of offerings have been bought by cornerstone backers, mostly mainland firms, out of the companies that have raised more than $500 million in Hong Kong IPOs.

Bankers said that China State Shipbuilding's investment underscores how state-owned conglomerates look for ways to invest their money.

According to the report, the oversupply of vessels and weak international trade has cased China State Shipbuilding to look for new sources of income, expanding into areas that include as real estate, bridge construction, steel-manufacturing and financing. The company said in its website that it operates in more than 20 fields, from metallurgy and aerospace to petrochemicals.

This year, the company also supported two other Hong Kong IPOs so far this year, committing $270 million to Bank of Tianjin Co's $1 billion April offering and also invested $50 million in the $799 million IPO of CDB Financial Leasing.

Rival state-owned shipbuilder China Shipbuilding Industry Corp. is also diversifying into non-shipbuilding business and also currently negotiating to invest in the Postal Savings Bank IPO, according to Liu Zhengguo, a company spokesman.