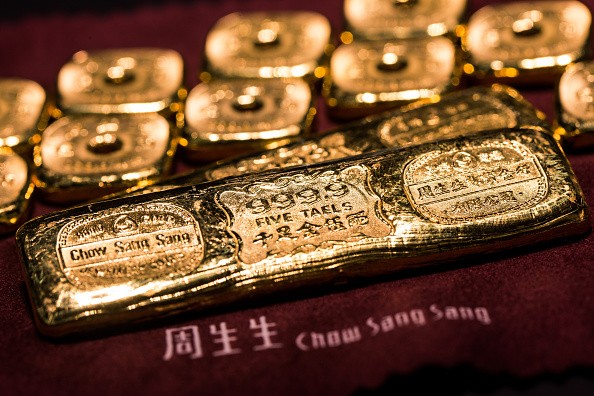

China has been named as the world's largest gold producer for the 10th year in a row.

The country produced more than 453.5 tonnes of gold last year, according to ifeng News via GB Times. This is a 0.76 percent increase from 2015 figures, asserting China's position as the biggest gold producer in a span of one decade.

According to the China Gold Association (CGA), consumers had bought over 970 tonnes of gold in 2016, declining 6.74 percent year-on-year.

Gold bar and coin investments jumped 28 percent and 36 percent, respectively, while investments in gold jewellery declined to about 19 percent.

Last year's unstable global political climate, particularly the U.S. elections and the so-called Brexit, contributed to consumers' increased interest in gold investments.

Similarly, a stronger dollar and the Federal Reserve's decision to lift interest rates attracted buyers to turn to gold investments, GBTimes wrote, citing CGA.

China's gold reserves are now at 1,842 tons, making the country second to South Africa with the largest gold resources.

Aside from gold, China's minerals business is also spread across other resources. Its imported iron ores account for almost 80 percent of use, while copper adoption constitutes almost 50 percent, according to Mining.com.

Despite being the second-largest country in terms of gold reserves, China had problems concerning its fast-paced "burn rate" of local mineral resources.

"China's reserves-to-production ratio represents the "burn rate" of domestic reserves and it's not surprising that the country's elevated consumption levels and increasing dependency on imports are raising alarm bells in Beijing," Mining.com wrote in a 2016 article.

This has pushed local buyers to go overseas as the gap between demand and capacity widened.

"Beijing's stated goal is to keep domestic mines' share to around a quarter of the total, but despite tax breaks and other incentives low grades and high costs have seen steelmakers opt for imports," Mining.com reported.