Lakala Payment Co. Ltd., one of the country’s earliest online payment providers, filed a prospectus for an initial public offering (IPO) on the Shenzhen stock market. Its move could make the company the first among its peers to list in China.

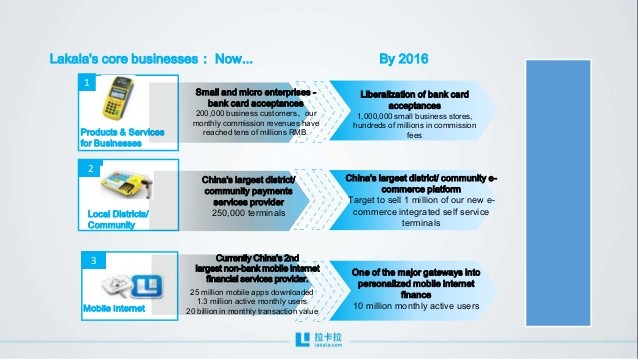

Lakala is backed by Legend Holdings Corp., a financial conglomerate. It was founded in 2005, and it has a core business that involves providing online payment services to individual consumers and selling point-of-sales machines to business users.

According to the prospectus that is posted on China Securities Regulatory Commission's website, Lakala Payment IPO plans to issue up to 40.01 million shares on Shenzhen’s small-cap ChiNext board.

Specific pricing details were not disclosed, but the prospectus indicates that all funds raised will be used to invest in a project worth 2 billion yuan. This project aims to integrate the online and offline service of Lakala, which will increase its customer base as well as support the company's expansion in the payments industry.

The prospectus also shows that Lakala made a net profit of 211.7 million from January to Sept. 2016.

Lakala is currently competing with big players such as Alipay, owned by Ant Financial, and Tenpay, owned by gaming and network giant Tencent. Both companies are currently dominating China's third-party payment sector, controlling nearly 90 percent of the online payment in 2015.

Lakala only ranked third place with 2.4 percent share of the market.

It attempted to go public last year after it was acquired by Shanghai-listed Tibet Tourism for 11 billion yuan in cash and shares. It was canceled though after the securities regulator tightened scrutiny of backdoor listings.

Aaron Guo, a senior analyst at Mintel, said: "It’s reasonable for Lakala to raise money if it wants to continue growing. But considering its size, there’s not much chance Lakala will be able to challenge the current market dynamic."