The demand for gold bars and coins in China rose 30 percent year-over-year to 105.9 metric tons in the first quarter of this year, the fourth strongest on record, according to a report published by the World Gold Council (WGC) on Thursday.

The increased demand contrasts with the global demand for gold in the quarter at 1,034.5 tons, an 18 percent year-over-year decrease from the record high level for the first quarter of 2016, the report said.

The report cited Chinese investors wishing to preserve value and hedge risks amid market uncertainty and currency volatility for driving the demand for gold.

"Investors, particularly individual investors, who wish to diversify their portfolio because of concern about the outlook for real estate and stock market, are having more interest in gold," Roland Wang, WGC China managing director, told China Daily.

For a similar reason, gold ETFs in China are also becoming more popular among institutional investors who are rediscovering gold as a tool for risk hedging when they are no longer focusing only on yield and allocating more resources on risk management, Wang added.

Strong demand for gold and limited growth of supply had also caused an imbalance, leading to a high premium in China over the global spot price, he added.

The premium for gold in the Chinese market averaged around $4 per ounce over the global spot price in recent years, but soared to an average of $17 per ounce at the end of 2016. This value persisted until the first quarter of this year at an average of $14.2 per ounce amid limited imports and a gap between supply and demand, according to the WGC.

Citing data from the China Gold Association, China's gold output in the quarter was 101.2 tons, a 9.29 percent year-over-year decline, while consumption (excluding exports and investments) grew 14.73 percent year-over-year to 304.1 tons, China Daily reported.

Several Chinese commercial banks, for example, have launched interest-bearing, online-tradable gold products with a minimum entry point of 1 gram, which also enables investors to withdraw physical gold through their bank networks, the report added.

"Financial technology companies are also tapping into gold-backed products that reach young investors, which effectively popularizes gold--an investment conventionally believed to be a favored investment tool for senior-age investors," Sinolink Securities Co. said in a securities note.

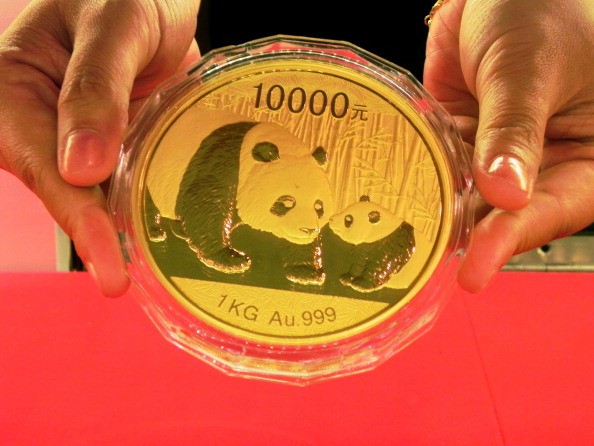

The Shanghai Gold Exchange continued to gain market share, as more high-net-worth buyers purchase 1-kilogram gold bars using the exchange's services at low margins.

The WGC said it expects China's appetite for gold in 2017 to reach 900 to 1,000 tons. India, the world's second biggest gold consumer, is expected to demand gold of 650 tons to 750 tons in 2017.