Many wealthy Chinese from the mainland are reportedly buying assets abroad in an effort to dodge the impending implementation of inheritance tax, the Want China Times reported.

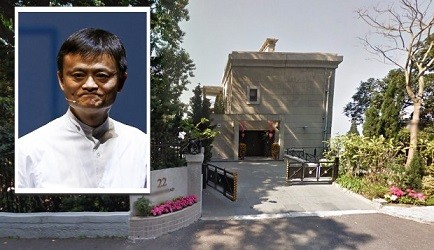

The report cited as an example Alibaba founder Jack Ma's recent purchase of a luxury house in Hong Kong, worth HK$1.5 billion ($193.5 million), the second property he bought in the city, after the other luxury house he bought for HK$282 million ($36.4 million) in 2007.

According to the report, Cheung Chung Kiu, chair of C C Land Holdings, bought the Hiu Kok Yuen, a luxury house with a 100-year history, for HK$6.3 billion ($812.6 million) in January, with an additional HK$5.l billion ($657.8 million) in tax, setting a record for the purchase of luxury property in the city.

According to Real Estate Circle, a Weibo account affiliated with National Business Daily, many rich people from the mainland have chosen to spend their fortunes in the Hong Kong realty market due to several reasons, which include the quality of life; the advanced medical facilities; Hong Kong's status as an international financial center; and the low tax rate, at 16.5-percent income tax, without capital gains tax or inheritance tax.

The report said that based on a provisional statute promulgated in Sept. 2004, the inheritance tax will be imposed nationwide following a levy hearing and trial in Shenzhen.

Under the law, inheritors must pay inheritance tax on progressive rates, capped at 50 percent on inheritance, 20 percent of which will be exempt from the tax. The statute also requires inheritors to pay the tax in cash within three months or face seizure of the inheritance or property.

Real Estate Circle said that inheritance tax may drive people to relocate their fortunes to other tax havens or even immigrate to places like the U.S., where inheritance takes only a maximum 35-percent tax rate beyond a $5-million exemption.

The National Business Daily affiliate also offered ways on how to legally evade inheritance tax, such as taking out life insurance policies, in which compensation is tax-free, or the setting up of family trusts for people with a high net worth.