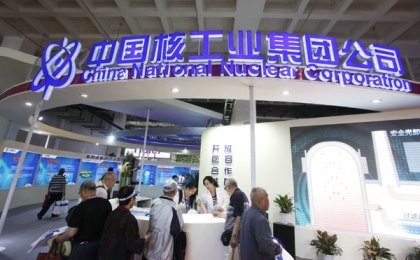

The application to launch a domestic IPO (initial public offering) of state-run China National Nuclear Power Corporation (CNNPC) has been approved, making it the first nuclear power company to make a public offering on the A-share market.

The Beijing Business Today reported that the CNNPC share offer is worth more than 16 billion yuan ($2.57 billion), which could be the largest that China has offered in five years.

The China Securities Regulatory Commission, the country's securities regulatory body, approved on May 20, Wednesday, the plan of the nuclear power company to sell up to 3.65 billion shares.

According to the report, 97 percent of the firm is managed by the China National Nuclear Group (CNNG), while the remaining 3 percent are shared by the China Ocean Shipping, China Three Gorges and an aerospace investment firm.

The report said that CNNG will sustain an absolute majority of shareholdings in CNNPC after it goes public.

All nuclear power plants operating in the country are managed by CNNPC, while CGN Power is affiliated with the China General Nuclear Power Group, the CNNPC prospectus said.

Based on statistics of the China Nuclear Energy Association, the country's nuclear power has generated nearly 130.6 billion kilowatts in 2014, with 40.41 percent or 52.8 billion kilowatts of it generated by CNNPC's seven nuclear power plants. The other six active plants are managed by CGN.

An emerging third player in nuclear plant operation, China Power Investment has also joined the construction of five new nuclear power plants in Zhejiang, Jiangsu and Liaoning. The company controls the Haiyang Nuclear Power Station in Shandong, which was approved in 2009.

The report said that CNNPC is expected to earn 16.25 billion yuan ($2.61 billion), with 7.05 billion ($1.13 billion) through the IPO, which will be used to replenish liquid assets and the remaining will be used to support the construction of the Fuqing nuclear plant in Fujian Province.

Funds will also be given to phase-1 construction of the Sanmen plant in Zhejiang Province, and the Changjiang and Tianwan plants in Hainan Province, the report added.

The funds that will be raised by CNNPC from the IPO are not enough to support the four nuclear power projects, which have a total budget of 154.4 billion yuan ($25 billion). However, market insiders said that the IPO was not aimed at raising funds, but designed to be used for the securitization of assets for CNNPC's future business operations.

The report added that China is expected to announce the revival of nuclear power construction at the 11th China Nuclear Energy Congress in Beijing on May 21. Insiders said that the CNNPC will benefit from the opportunity, being the only nuclear power company listed on the A-share market.