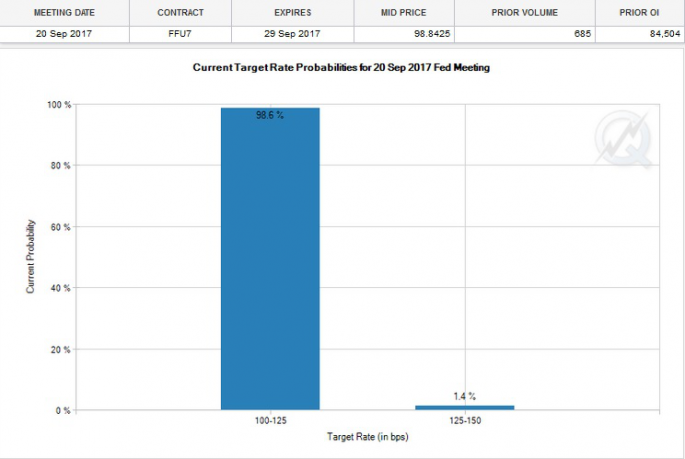

The current interest rate in the United States is 1.00% - 1.25%. At its last meeting on July 26, 2017, the Fed left the federal funds rate unchanged, after poring over US economic data. The current interest rate is likely to remain in the region of 1.00% - 1.25% for several months. According to the CMEGroup FedWatch tool, the probability of a rate hike on Wednesday, 20 September 2017 is just 1.4% (for an increase of 25-basis points), and the probability of the rate remaining unchanged is 98.6%.

Projections for 1 November 2017 are similar. The probability of a 25-basis point rate hike is just 5.3%, while the probability of rates remaining in their current range 1.00% - 1.25% is 94.7%. As we move towards the end of the year, the probability of a rate hike increases sharply. The likelihood of the federal funds rate remaining at its current level of 1.00% - 1.25% is just 58.0%, while the probability of a 25-basis point rate hike to the FFR increases to 39.9%. A rate hike of 50-basis points is associated with a probability of 2.1%. The statistics clearly show that the conditions in the US economy are not sufficiently bullish to warrant an increase to the federal funds rate.

Fed Will Hike Rates When Dual Objectives Have Been Reached

Broadly speaking, the Fed is likely to increase the FFR when the conditions in the economy warrant such a change. Interest rate increases are typically associated with rising levels of inflation. The Fed has set an inflation target of 2.00%, but the current inflation rate in the US is below the target rate. The other objective is full employment.

Currently, the unemployment rate in the US is 4.3%, and that is considered a full employment level. Increases in interest rates are associated with greater demand for the USD. The reason being: higher interest rates attract foreign capital. Speculators and currency traders will ditch foreign currency such as the JPY, GBP, EUR, ZAR, and others in favour of the USD when the Fed raises interest rates in the United States.

The Complex Relationship Between Interest Rates and Bourses

The impact of rising interest rates on equities markets is equally clear. Companies listed on Wall Street tend to be heavily indebted to banks and financial institutions. The cost of loans is directly related to the interest rate. As the rates rise, so companies will be required to pay higher levels of interest. This erodes profitability, and ultimately gets passed on to consumers in the form of higher prices.

The initial reaction of an interest rate hike is bullish sentiment on markets. It indicates that the Fed and the monetary authorities (FOMC) perceive the US economy to be red hot. However, as time progresses, higher interest rates are associated with rising levels of inflation. While nobody wants inflationary pressures, higher interest rates pay more on savings (fixed deposit accounts, savings accounts etc.) and they also remove excess liquidity from the financial markets. This makes the USD more valuable to currency traders.

In response to the global financial crisis, the Fed reversed course on monetary policy and started a process of quantitative easing. Monetary accommodation is designed to kickstart the economy to accelerate the velocity flow of money. The Fed began cutting interest rates sharply to encourage borrowing, credit expansion and economic growth. The Fed also began buying up bonds, and other financial assets. It did this to flood the markets with money. Currently, the Fed's balance sheet is worth an estimated $4.5 trillion. Now that the US economy is on song, the Fed is looking to unwind its balance sheet and remove excess liquidity from the economy.