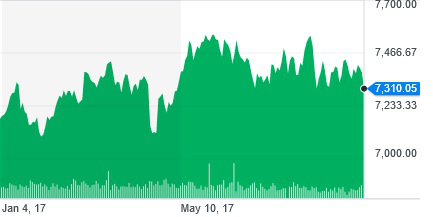

The FTSE 100 index is trading around 7,306.85, with a 52-week low of 6,654.80 and a 52-week high of 7,599.00. The FTSE 100 moves in the opposite direction to the strength of the GBP. Since the June 23, 2016 Brexit referendum, the FTSE 100 index has rallied, and spread bettors have placed net long positions on the UK all-share index. Approximately 70% + of revenues generated on the the FTSE 100 index are based overseas, and a weaker GBP means that repatriated profits are worth more. Consider that on June 23, 2016 the FTSE 100 index was trading at 6,338.10, and it hit the 7,000 mark by October 4, 2016 when it broke through the critical 7,074.34 level. By January 2017, the FTSE 100 index had firmly established itself over 7,000, averaging around 7,250. The continuous depreciation of the GBP pushed the UK all-share index higher, reaching 7,599.

Forecasting Price Movements of Underlying Assets

With spread betting activity, traders speculate on the price movements of financial assets. Traders simply forecast the future price movement of the underlying asset, and whether the underlying asset's price will be higher or lower than the offer or the bid respectively. As a case in point, let's assume that the FTSE 100 index is currently at 7,320.60. If the quote for the FTSE 100 is 7320.1 - 7321.1, the fixed spread is one point. A trader who is bullish on the FTSE 100 index, perhaps the trader is expecting the GBP to depreciate, will buy the option at 7,321.1. However, if the trader is bearish about the FTSE 100 index, perhaps the trader believes that the GBP will strengthen with a rate hike, he/she will sell the FTSE 100 index at 7,320.1. If you decide to take that option and sell with the down bet, and you have wagered £5 per point, these are the possible scenarios that you can encounter:

1. If the FTSE 100 index level falls, and reaches 7,197.6 and the quote is now in the region of 7,197.1 - 7,198.1, your original sell bet for the up bet (to buy) will be 7,198.1. Based on the current stake and differential, the tax-free profit in this case could be as much as £610.

2. If the FTSE 100 index moves higher than the current level toward £7,410.0, and the prevailing quote is 7,409.5 - 7,410.5, you will buy at 7,410.5. In this case, your loss incurred will amount to £452.

Spread Betting as a Viable Income Stream

Leading trading platforms such as ETX Capital offer a range of tradable assets for spread betting purposes. These include some 5,000 markets for bonds, commodities, indices, Forex and shares. There are many benefits to spread betting, including no capital gains tax and no stamp duty for the UK. Traders can enjoy trading activity on a wide range of financial instruments, including Gold, the DAX 30, the FTSE 100 index, CAC 40, GBP/USD, GBP/EUR, and EUR/USD.

Today, spread bettors can generate significant income streams on PC, mobile (Android and iOS) devices, on the internationally acclaimed MT4 trading platform, or proprietary trading platforms. It is imperative that traders pick platforms with rapid execution of trades, tight spreads, and low margins. Charting tools, trend analysis, and an education centre are preferred. The leading spread betting brokers offer a wide range of FX majors, minors, Scandinavian currencies, emerging market currencies, forwards and the like.

Typically, different financial markets will open/close at different times. At times, there may be spikes in pricing, or decreased liquidity which affect market opening hours. There are several tips and tricks that can help you to succeed as a spread bettor, notably conducting the necessary research, discipline, loss management, setting targets and effective bankroll management. The biggest benefit of spread betting is its tax-free nature. You can trade across some thousands of markets and that means traders are likely to find an option they are comfortable with.