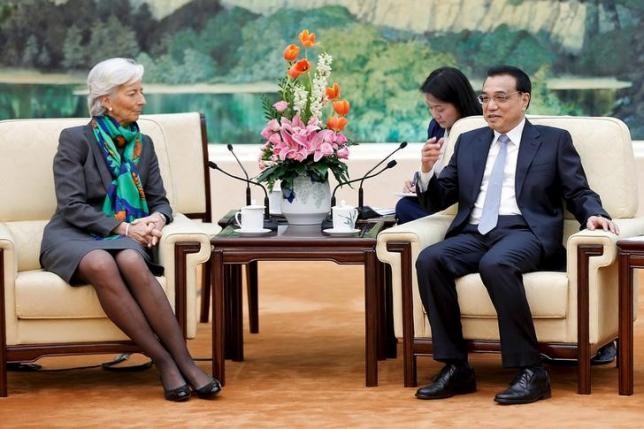

Premier Li Keqiang has assured International Monetary Fund chief Christine Lagarde during a telephone call on Thursday, Jan. 28, that the Chinese government "has no intention to boost exports by devaluing the renminbi, not to mention waging a trade war," China Daily reported.

Li also said that China "is able to maintain continued, steady growth of its economy," during his conversation with the IMF chief about the economic and financial situation in China and around the world.

Li's comments will help dispel doubts over alleged currency manipulation by China and its future economic prospects, observers noted. Despite last year's 6.9-percent growth, the country's economy continues to face downward pressure.

"The fact is that the renminbi exchange rate has remained basically stable against a basket of currencies, and there is no basis for continuous depreciation of the renminbi," Li was quoted as saying.

According to the premier, China will "press steadily ahead with the reform of mechanism to formulate the yuan exchange rate," strengthen its communication with the market, and maintain the stability of the yuan exchange rate at an appropriate and balanced level.

For her part, Lagarde expressed belief that through measures such as structural reform, keeping the exchange rate policy stable and boosting communication with the market, the Chinese government could maintain steady economic growth.

The IMF chief added that the IMF is willing to further strengthen communication and cooperation with China.

A Bloomberg report quoted Lagarde as saying during a panel discussion in Davos, Switzerland, last week that China's policymakers have shown "unbelievable determination" to deliver reforms in the past.

Chen Fengying, a senior world economy researcher at the China Institute of Contemporary International Relations, said that Lagarde and the IMF have become important channels for China to send signals to the world market in such a critical time.

"As uncertainties cloud the market, Li has stated China's confidence in the economy and currency. Without such remarks, the stock and currency markets' confidence could be more vulnerable," Chen said.