Li Weihua of the China University of Political Science and Law said that consumers were more interested in fast food five years ago.

He said, "There would definitely have been more buyer interest five years ago, but at that time they were doing so well that they couldn't bear to sell."

McDonald's first set foot in China in 1987. Now, the burger giant has 2,200 outlets.

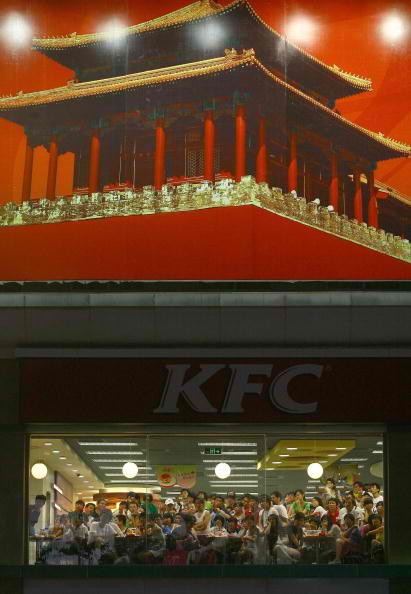

Yum! Brands, operator of KFC and Pizza Hut, has 7,200 outlets. The company used to dominate the market with a share of 40 percent in 2012.

However, Euromonitor International recent data shows that the market share for both companies is slipping. Yum's share slipped to 23 percent, while McDonald's slipped to 13.8 percent from 16.5 percent in 2012.

The slip on revenue is caused by a change in consumer's preferences to healthier food. Data showed that in 2015, 48.8 percent of the market are divided among restaurants which sell local dishes like steamed dumplings or steamed rice.

Yum Brands is reacting to the trend by selling 20 percent of its stake to its separate Chinese entity. The valuation of the stake is at $2 billion.

McDonald's is making a similar move, abut bidders were turned off by stringent conditions set by the fast food company. Bidders include Beijing Sanyuan Foods Co, Sanpower Group Co, and Beijing Tourism Group.

McDonald's tried to enter the health food craze by lessening preservatives in their nuggets. They also shifted to using free-range chickens.

McDonald's U.S. President Mike Andres commented that the consumer's change on food quality is important to the company. He said, "If it matters to our customers, it matters to us."

Despite the adjustments made by these two companies, Chinese consumers seem to be unconvinced. The Euromonitor data showed that from 2014 to 2015, Yum lost about $3 billion while McDonald's stayed at $18 billion.

Li thinks that consumers are now trading up to more premium but economic types of food and the fast food chains have lost their sparkle as American brands.

"Once the novelty factor wears off, there's nothing keeping consumers going there as local chains are cheaper and often more dynamic in meeting local tastes and preferences," he said.