Fujian Grand Chip Investment Fund's proposal to purchase Aixtron, a Germany-based semiconductor equipment maker, was blocked by U.S. President Barack Obama, citing national security as the main reason, the Global Times reported.

China responded by saying that the acquisition is part of "a normal business activity" as Chinese foreign ministry spokesman Geng Shuang warned against U.S. interference in the deal, the report said.

According to experts, mergers and acquisitions by Chinese investors will be further scrutinized by the U.S. government, as Donald Trump assumes office. The President-elect plans to set higher approval standards and implement the principle of "reciprocal opening" in terms of foreign investment.

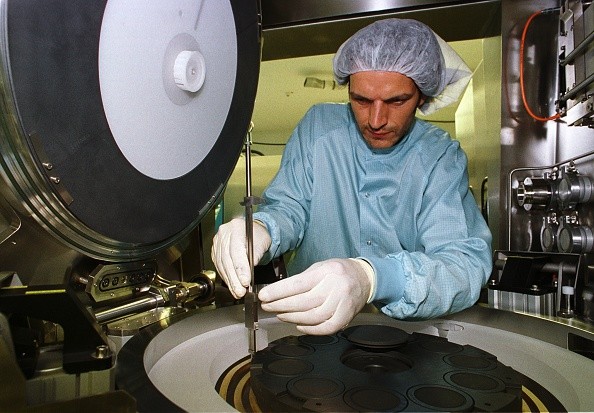

In May, Fujian Grand made the offer to take over Aixtron for $714 million, in a deal that includes its California-based subsidiary. The proposed takeover would "provide the company with financial resources to deepen research and development," analysts said.

On Friday, Dec. 2, the U.S. government announced that it is blocking the acquisition based on the recommendation of the Committee on Foreign Investment in the United States (CFIUS).

About 20 percent of Aixtron's total sales came from its U.S. business, which explains why the U.S. Treasury Department is getting itself involved in the deal.

Based on the CFIUS review, the deal could expose sensitive technology with military use to the Chinese, the Treasury Department claimed.

A statement from the department said that the "CFIUS and the president assess that the transaction poses a risk to the national security of the U.S. that cannot be resolved through mitigation."

However, on Saturday, Dec. 3, Aixtron released a statement saying that "the presidential order was limited to the U.S. business and did not prohibit the acquisition of Aixtron shares."

If the deal is blocked, Aixtron said in an earlier statement before the CFIUS announcement, that it will have to "take actions to balance income and costs, including potential job cuts," Reuters reported.

He Weiwen, an executive council member at the China Society for the WTO, told the Global Times that "there are several months left for public relations companies and law firms to lobby against the US recommendation and convince (the government) that Chinese investors will not utilize semiconductor products in the military sector."

Zhang Jiayuan, an analyst with China Investment Consulting Co, noted that the U.S. stance may not be easily swayed and Trump may likely support Obama's decision, considering his statements on China during the campaign.

Trump has accused China of unfair trade practices and as a response, he wants to impose a tighter restriction on U.S. exports to China as well as impose 45 percent tariffs on China's imports.

According to experts, Trump may also implement the principle of "reciprocal opening," in which U.S. companies may open businesses in sectors where Chinese companies invest in the U.S.

In recent months, U.S. authorities have turned down several proposals by Chinese investors. Blackstone's plan to sell a Southern California hotel to Anbang Insurance was cancelled after the CFIUS expressed concern that the hotel was located at a very close distance to a U.S. major naval base.