China’s department stores are taking a beating in the international market this year, as e-commerce retailers like Alibaba Group Holding Ltd. are increasingly gaining interest from Chinese consumers and with anti-corruption drives pinching sales.

Department store notes dropped 2.7 percent since the end of December the previous year, more than any other sector with more than one issuer in the Bank of America Merrill Lynch securities index from China, Bloomberg reported on Thursday.

The country also announced its economic growth target to be at 7 percent this year--the lowest in more than 15 years--as Beijing's senior officials push for an anti-graft probe that has curtailed sales.

Meanwhile, online retail sales in China rose nearly 50 percent in 2014, surpassing the 12-percent increase for all retail sales of consumer goods, according to data from the National Bureau of Statistics.

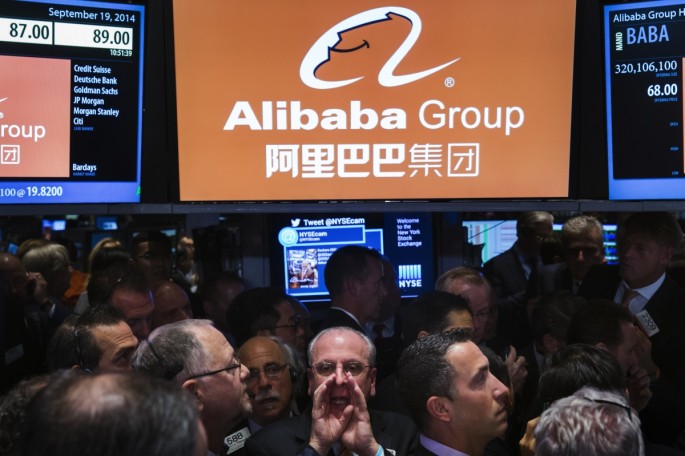

Combined sales through Alibaba's e-commerce platforms Tmall.com and Taobao Marketplace grew by 49 percent in the fourth quarter from the same period in the past year as the e-commerce giant expands to smaller cities, according to company filings.

"The downturn for China's department stores has a lot to do with the rapid rise in e-commerce, the ongoing anti-corruption campaign and a soft economy," said Lillian Chiou, credit analyst at S&P in Hong Kong.

Overall, Alibaba's revenue growth rose by 40 percent, which is short of its initial projections, although analysts see this as due to increased competition from e-commerce rival JD.com, Inc.

High-yield notes from Chinese department stores recovered from lows earlier this year with recent rate cuts by the People's Bank of China bolstering credit-market sentiments.

However, the industry still faces long-term challenges from increasing competition from online retailers, Oscar Chow, head of the Asia credit research branch at Mitsubishi UFJ Securities HK Ltd., said in an interview.

"Brick and mortar retailers in China have been shrinking for some time now and I don't think the turnaround will happen any time soon," Chow added.

2017 notes from Maoye fell 3.2 cents on the dollar this year to 94.8 cents, according to a Bloomberg report. It further slid down to a record low of 92.8 cents the previous month.

Securities due 2023 from Nanjing-based Golden Eagle Retail Group Ltd. remained down at 5.3 cents on the dollar since Dec. 31 at 86.6 cents even after rebounding from a record low of 81.3 in January.

The 2018 bonds of Parkson Retail Group Ltd. also dropped to an 11-month low of 89.5 cents in February, and are at 92.2 cents as of writing.

"The role of department stores as a key retail format in China will diminish over time, as more shopping malls are built amid urbanization and online retail platforms grow in popularity as mobile Internet penetration rates rise," Lina Choi, analyst at Moody's Investors Service, wrote in a research report this week.