A survey has found that affluent Chinese preferred United Kingdom brands for gifts, jewelries, shopping and cars, including the country as a travel destination.

Hurun reported that in terms of fashion brands, Chinese men consumers prefer Burberry items as gifts over L.V. Moutai and Chanel.

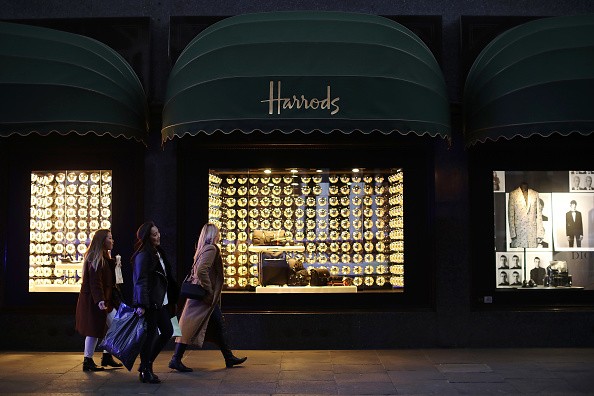

As for shopping, Chinese consumers prefer shopping at Harrods, a British department store, which has been winning the Best London Luxury Shopping Destination for fourth consecutive year.

Meanwhile, Backes & Strauss was named Best British Jewelry Watch brand for the first time.

For automotives, rich Chinese people preferred British luxury car Rolls-Royce’s Ghost model as the Best Super Luxury Executive Car, followed by Bentley’s Mulsanne.

Rolls-Royce Wraith won the Best Luxury Car for Self-Drive, while Ashton Martin DB9 followed. Ashton Martin’s DB11 model was named Super Car Best New Arrival, while Jaguar’s XFL won Executive Car Star Performer.

For the second consecutive year, Range Rover won Best Luxury SUV in the SUV category.

As for travel, Hotels.com reported that it has become an essential part of life for two-thirds of Chinese travelers and travels to the UK have increased extensively.

Chinese often allot more days for traveling despite their busy schedule, said Rupert Hoogewerf, chairman and chief researcher for Hurun Report.

“Chinese they take 10 days for holidays, three more days than last year, whilst the super-rich take five more days than last year to 15 and go abroad 3.4 times a year on average, twice for traveling,” said Hoogewerf.

But as for cities to live, Chinese people still prefer San Francisco, Seattle, and Los Angeles in the United States; while London only landed on the 14th place.

The “UK Luxury Brands in China” report is a focused summary based on the “Best of the Best Awards 2017” survey and the “Chinese Luxury Consumer 2017” study.

It involved 449 Mainland China millionaires with personal wealth of 10 million yuan ($1.4 million at current exchange) who were surveyed between Sept. and Dec. 2016.

Last year, Yibada reported that the number of Chinese individuals having 1 million yuan ($151,700) to 5 million yuan worth of investable assets is estimated to reach 12.3 million this year, up from 11.16 million last year, according to a report released by Forbes China and China Pacific Insurance Group.