The central banks of China and the U.S. are set to implement higher interest rates on the basis of differing reasons.

According to an article in The Australian, the U.S. Federal Reserve saw positive economic data to increase interest rates on March 16, the second time in three months. Two more rate increases will be implemented this year, amid rising wages and increasing business confidence, the report said.

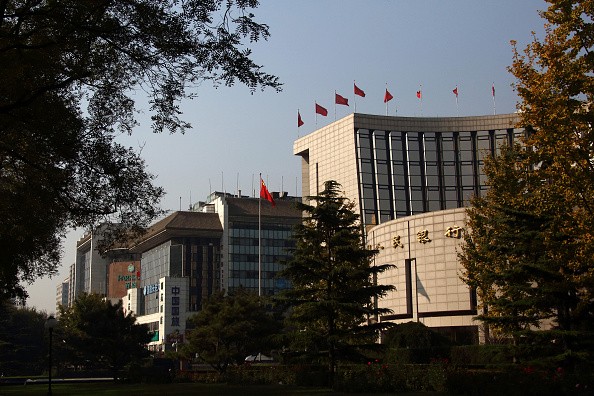

Meanwhile, China officials are concerned about asset bubbles and the surge of investments in stocks, bonds, artwork and real estate, which prompted China's central bank, the People's Bank of China (PBOC), to resolve financial risks and rising credit, placing them on top of its priority this year.

But as the U.S. raised its rates, the dollar is expected to further strengthen against the Chinese yuan and may drive more capital outflows from the country.

Since 2014, China has spent about one-fourth of its foreign exchange reserves to prop up the yuan while Chinese authorities implemented measures to curb the outflows.

Analysts said that the recent Fed rate increase could drive the PBOC to further tighten its monetary control.

"Local investors used to only pay attention to domestic factors," Ken Hu, chief investment officer for Asia-Pacific fixed income at Invesco in Hong Kong, said. "Now, they've woken up and suddenly realize they need to pay attention to US monetary policy."

Last month, China increased key short-term borrowing rates as the yield on its benchmark 10-year government bond climbed to 3.486 percent, the highest in a year and a half, according to Thomson Reuters. The level was last at 3.385 percent.

For Chinese companies, a higher bond yield means a more costly borrowing from Chinese banks. Because of this, some companies raise debt outside which is cheaper, although it is in U.S. dollars.

Dealogic said that about $16.7 billion in debt were raised offshore by Chinese companies this year while about $23.5 billion were raised in China.

Some companies have sold their U.S. dollar bonds as the government crackdown on financing in the property sector.

China's central bank is being pressured to interest rates as the government is trying to keep a balance between excessive credit and the 6.5 percent economic growth target.

Last year, China raised short-term borrowing costs to make it difficult to get cash to be invested in bonds and commodities.

Data from BNP Paribas show that short-term lending for market speculation has dropped as banks now make about 65 percent of their borrowing in overnight markets.

But although the leverage on financial markets has been reduced, China's economy is still dependent on debt. JP Morgan said that the total corporate debt in China was 150 percent of GDP at the end of September last year.

"Financial market leverage is a problem that can be resolved in months," Shuang Ding, chief China economist at Standard Chartered in Hong Kong, said.

"The leverage in the economy is unlikely to be resolved in years."