Australia set the condition, among a number it demanded, that no single country should control the Asian Infrastructure Investment Bank (AIIB) before it decides to join.

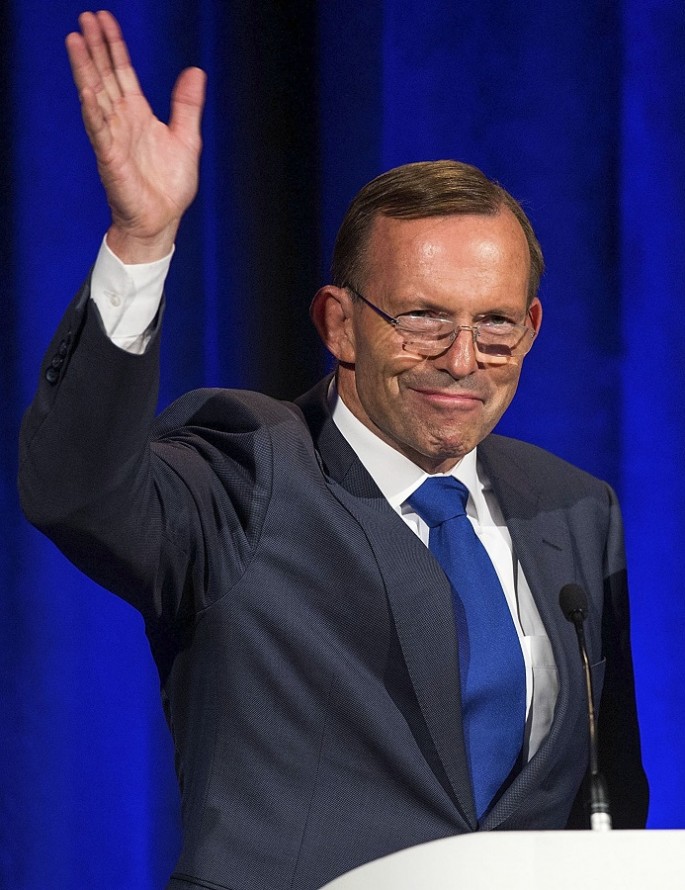

"Key matters to be resolved before Australia considers joining the AIIB include the bank's board of directors having authority over key investment decisions, and that no one country control the bank," said Australia's Prime Minister Tony Abbott, Treasurer Joe Hockey and Foreign Minister Julie Bishop in a joint statement.

The Australian ministers also emphasized that their membership in AIIB should not preclude their cooperation with the top western financial institutions.

Nonetheless, the Australian government said on March 29 that it would sign a memorandum of understanding that will allow it to take part in negotiations as a prospective founding member to set up the bank.

The Australian ministers admitted that the AIIB has the potential to address infrastructure needs and boost economic growth in the region.

Meanwhile, Denmark filed its application on Saturday.

China welcomed moves by both countries to become founding members of the AIIB.

Upon approval by exisitng members, Denmark will be a founding member by April 12 and Australia on April 13.

Mogens Jensen, Danish Minister of Trade and Development, noted that since many of Denmark's trade and development cooperation interests will be at stake in the AIIB, there are reasons to be part of the group from the beginning.

The $50-billion bank was established last October by China and 20 other countries.

A March 31 deadline has been set to become a founding member of the AIIB.

Italy, Russia, Britain, France, Germany and the Netherlands have also expressed interests in joining.

The Beijing-based bank, which will support infrastructure projects in Asia, is expected to be established by the end of this year.

China is expected to foot the bulk of the money needed to start operations of the bank, which is set to increase its total fund to more than $100 billion.