A series of supportive measures has been approved by the Chinese government on Wednesday, Aug. 26, to develop financial leasing, as part of efforts to deepen financial reform and ease difficulties of funding, the China Daily reported.

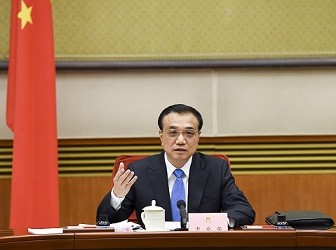

In a meeting presided over by Premier Li Keqiang, the State Council executive committee decided to remove the minimum capital requirement for financial leasing for companies when setting up subordinate businesses, streamline administrative procedures for exporting agricultural and medical equipment, and encourage the leasing of equipment in high technology and clean energy sectors.

The statement released after the meeting said that the move was aimed to encourage companies to invest more in better equipment and simplify the restructuring and upgrading of industries.

The State Council also passed policies to reduce fees collected during the export and import procedures to encourage trade.

Cong Lin, CEO of ICBC Financial Leasing, a specialist leasing operation of the Industrial and Commercial Bank of China, China's largest commercial bank, said that the measures will become a blueprint or outline for the development of the industry.

When launched in 2007, ICBC's leasing arm was the first of its kind in the country.

Cong said that since national strategies require large amounts of capital, financial leasing will provide support to national strategies, such as the Belt and Road Initiative and its plan to upgrade manufacturing industries by 2025.

"The development of financial leasing will also create more opportunities for international industrial capacity cooperation and the 'going global' of Chinese enterprises," Cong was quoted as saying.

A report released by the China Financial Leasing Association showed that China's financial leasing market is expected to hit 5 trillion yuan ($780 billion) during the first half of next year to become the world's largest, exceeding that of the United States.

Tian Hui, a research fellow with the Institute for Finance of the State Council's Development Research Center, said that financial leasing as an emerging industry has developed rapidly in recent years, and the industry has great potential for further development.

"A large proportion of financial leasing is in the sector of infrastructure construction, which is in tune with China's investment-driven model of development," Tian said.

Tian added that the surge in financial leasing activities may be party attributed to listed Chinese companies tapping the service for cheap credit.

According to the report, companies in agriculture, telecom, energy and equipment manufacturing and pharmaceutical sectors use sale-leaseback, a business model in financial leasing that helps companies obtain financing by renting assets that they sold earlier.