Premier Li Keqiang’s comments on Friday, Aug. 28, that China’s economy is within control and a continued depreciation of the yuan has no basis will provide encouragement and help restore confidence among investors, analysts said on Sunday.

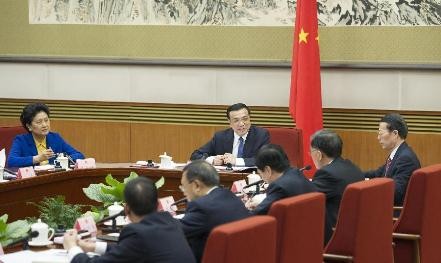

The Global Times reported that Li made the pronouncements during a State Council meeting on economic conditions held on Aug. 28, following the release of July economic indicators and turmoil in the global stock and commodity markets in the past few weeks.

Li noted that fluctuations in the international markets have contributed to uncertainties in the global economic recovery, which have affected China's financial markets as well as its imports and exports.

The premier, however, said that China's proactive fiscal policy and prudent monetary policy, as well as its targeted macro-control measures, will help achieve its major economic goals set this year.

"China still leads the world in terms of economic growth," Li said. "The country is also capable of effectively managing risks."

Analysts said that Li's remarks have encouraged investors amid the pessimistic outlook for the Chinese economy.

Li Shaojun, an analyst with Minsheng Securities, said in a research note that it was in the second high-level meeting where the current economic situation was discussed. Before that, a meeting of the Political Bureau of the Communist Party of China Central Committee was held on July 30.

Li Shaojun said that government measures to support the economy are expected to start producing results in the fourth quarter of this year.

China's stock markets dropped in the past few months, with the Shanghai benchmark index falling nearly 40 percent after it peaked on June 12.

"The development of the domestic economy in the rest of the year will be better than some market expectations," Zhou Jingtong, an analyst with the Bank of China, said, adding that China's GDP growth is expected to stay at 7 percent in the third quarter.

Fitch Ratings said in a report on Aug. 26 that market pessimism about the short-term macroeconomic outlook in China is probably excessive.

On Aug. 25, China announced a cut in benchmark interest rates and banks' reserve requirement ratio, which highlighted the authorities' policy flexibility in supporting the economy and more significant room to further loosen policy.

Xu Hongcai, an economist with the China Center for International Economic Exchanges, predicted that China's GDP growth may drop to 6.8 or 6.9 percent in the third quarter, after exports fell sharply in July and the domestic stock markets suffered losses during the period.

Xu also said that the country's stable domestic economic growth and sound financial condition are factors that will support the yuan in the future.