The Chinese government is set to adopt a new national market system come 2018 in a bid to boost market appeal.

So-called "negative list," the system aims to identify sectors and businesses that are considered off-limits. This will be added to the current investment approval method of categorizing sectors into "encouraged," "restricted," and "prohibited."

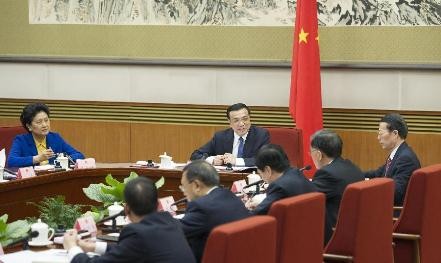

The guideline regulating the negative list approach was approved last week during a meeting of the Central Leading Group for Comprehensively Deepening Reforms, which was presided by the Chinese president himself, Xi Jinping.

Though the implementation will commence nationwide in 2018, the approach will be piloted in key regions for the next two years.

According to a commission official, the negative list approach will be applied equally to both domestic and foreign investors and to private and state-owned ones.

The official emphasized that the details are still to be divulged, though he revealed that the guideline will include a top-level design for negative-list policies, highlighting the tasks, requirements and support policies.

The commission shared that the new system will be applied to mergers, initial and additional investment, and market entry practices. It also said that the list must conform with the law and be drawn up in a gradual, transparent manner.

The State Council will be tasked to formulate the list and the local governments will have no authority to alter the items, unless they would win the council's approval.

According to Zhang Jianping, a senior researcher at the commission's Institute for International Economic Research, "it's significant to switch to a negative list management system, and China will unleash more potential to attract foreign investment, particularly in the service sector."

The new approach received a major push after it was adopted by the China (Shanghai) Pilot Free Trade Zone when it was established in 2013.