As the economic slowdown is felt on Alibaba consumers' spending behavior, more investors are turning their attention to the e-commerce giant's mobile and online video platforms.

Recently, Alibaba announced that it has offered a $3.5 billion proposal to buy Youku Todou Inc., one of the country's largest online streaming sites.

This investment is seen by industry analysts as a way for Alibaba to sustain long-term growth amid the slowing of China's economic development.

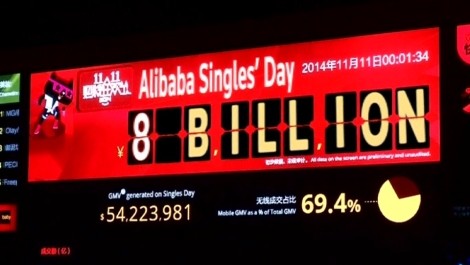

Investors are also keen on how the leading e-commerce firm will set their plans and targets for this year's online shopping festival, which will take place on Nov. 11. During the occasion last year, Alibaba has set a record of $9.3 billion worth of online sales.

According to the analysts surveyed by S&P Capital IQ, Alibaba's net profit for the second quarter likely rose by 52 percent to $730 million.

Meanwhile, the revenue is expected to increase by 27 percent to $3.36 billion.

Over the past year, Alibaba's shares have diminished by around 40 percent. Experts have cited economic woes, intensified competition and unsatisfactory revenue growth as the main reasons.

Addressing the concern, Executive Chairman Jack Ma reassured its shareholders about the firm's prospects. He also expressed optimism on the behavior of their consumers.

Despite Ma's statements, some analysts have still trimmed down their estimates of Alibaba's earnings, stock price, and gross merchandise volume "to reflect macroeconomic headwind and rising competition."

Nonetheless, industry insiders have still named the e-commerce giant as the investors' "top pick" for the sector.