Amid an unprecedented surge in overseas acquisitions, China's buying spree in Europe recently faced delays as Germany withdrew approval for the 670m euro takeover of Aixtron, a chip-equipment maker, by Fujian Grand Chip, an investment fund.

Although this could be part of regulatory delays similar to what ChemChina experienced in the proposed $44-billion takeover of Syngenta of Switzerland, the move suggests that Europe is taking a second look at China's deals, which it believe must be taken seriously.

A report by the Financial Times said that Chinese firms are not alone in this as foreign companies that want to acquire businesses in China face a similar predicament, or sometimes heavier obstacles imposed by the Chinese government that range from legal restrictions on foreign ownership to other regulatory and informal barriers.

Chinese firms however, are not only focused on Germany's small and medium-sized firms. In the U.S., Dalian Wanda has been taking on Hollywood firms and this week, HNA Group bid $6.5 billion to gain 25 percent share in the Hilton Hotel chain.

But Germany saw some reasons why the surge in Chinese direct investments must be given second thoughts and taken seriously. The withdrawal of the approval for Aixtron takeover was preceded by a series of acquisitions of companies involved in advanced manufacturing technology.

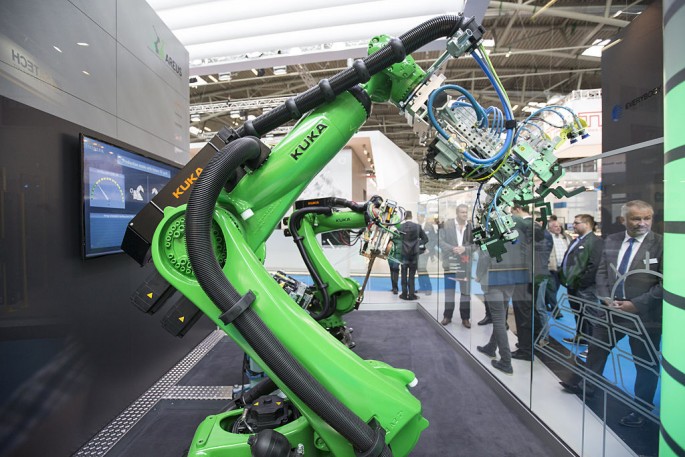

This year, Midea, a household electronics company, bought Kuka, a German maker of industrial robots while other Chinese companies acquired German manufacturers of concrete pumps and machine tools.

The "Made in China 2025" plan, which was unveiled last year, made it clear that if China cannot surpass advanced companies in Europe or the U.S., it will acquire them as the plan calls for a shift into advanced manufacturing in ten industries, which include aerospace, robotics and machine tools, information technology and medicine.

The report said that there was nothing wrong or sinister with Chinese companies buying foreign firms as it was better than the old strategy where foreign companies that wanted access to China have to form joint ventures with Chinese companies and require them to transfer their technology.

China acquisition of expertise in robotics and advanced technologies does not undermine the security of the West, the report said, but it was natural reaction as light manufacturing shifted to countries with lower wage rates.

What European companies complain about is that the investment flows is one-sided as China has succeeded mostly in its acquisitions while Western companies in China are confronted with problems in entering the market.

But China's advance is a result of its accession to the World Trade Organization in 2001 when it tried to fill the trade gap as the world's largest exporter of goods.

The EU is now pressing China to give European companies easier access and Germany, unlike the U.S., lacks the mechanism to check the deals and resolve what it perceives is an imbalance.