An investment fund of about 10 billion euro ($11.15 billion) has been set aside by the Industrial Commercial Bank of China (ICBC) to finance infrastructure projects in Central and Eastern Europe (CEE), the bank said in a statement released on Sunday, Nov. 6.

Reuters said that Sino-CEE Financial Holdings Ltd, a company put up by ICBC earlier this year, will manage the fund, which is called the China-Central Eastern Europe fund. Chinese Premier Li Keqiang formally launched the company during his visit to Riga on Saturday, Nov. 5.

According to the statement, China Life Insurance and Fosun Group are also involved in managing the fund.

ICBC said in the statement that it is planning to raise about 50 billion euros in project finance which will cover sectors such as infrastructure, high-tech manufacturing and consumer goods.

The bank said that although the project is focused on Central and Eastern Europe, other regions that are related to China-Central and Eastern Europe cooperation, may also be covered.

ICBC added that though the fund is supported by the government, it will be market-driven and will run under business principles.

As China's economy is currently slowing, it needs to find new export markets in Central and Eastern Europe as part of the modern Silk Road established by the country.

Last year, Chinese vice commerce minister Gao Yan said that more than $5 billion have been spent by Chinese companies in various investments in CEE countries.

China's move to increase its investments in the region, known as the gateway to the European Union, come s at a time when Germany is calling for limitations to Chinese investment in some industries.

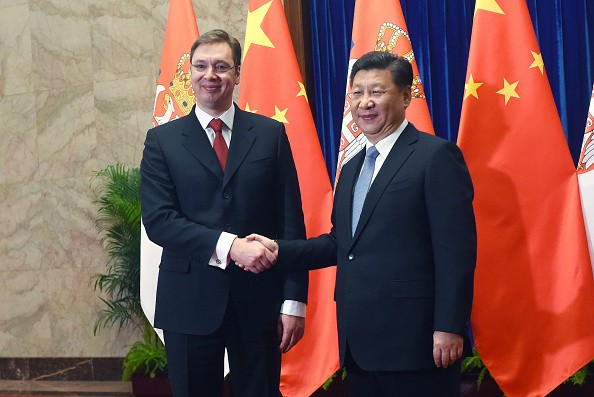

Leaders from China and 16 central and eastern European countries, a group dubbed by China as "16+1," are expected to attend an upcoming summit that will be hosted by Riga, the report said.