The maker of the location-based instant messaging app Momo is reported to make an initial public offering (IPO) on NASDAQ this Dec. 12, said IPOScoop.com, a U.S.-based financial news website.

Momo, under NASDAQ code "MOMO," is planning to release 16 million units of American depository shares (ADS), which will be offered at a price of $12.5 to $14.5. Momo is expected to take in up to $232 million from the IPO.

Momo's IPO application was submitted on Nov. 8 to the U.S. Securities and Exchange Commission (SCE). It is considered to be the first mobile firm in China to be listed in the U.S. stock market.

Underwriters were given 2.4 million ADS by Momo for the greenshoe option, which may result in Momo raising as much as $266.8 million from its IPO.

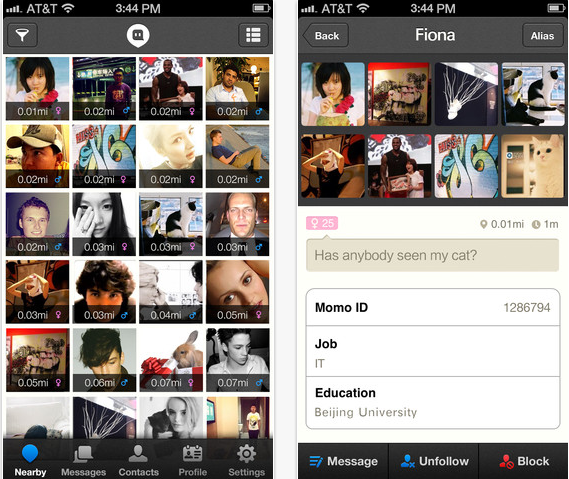

The Momo app utilizes the user's location data or a common hobby to find other users to chat with. As of the end of September, more than 180 million users registered with the app, a 160.8-percent increase from 2013.

Tang Yan, former NETEASE editor-in-chief, founded Momo in Aug. 2011. The app generated $3.1 million in 2013 and a staggering $13.9 million in just the first two quarters of 2014.

The app's primary source of profit come from mobile-gaming and membership fees.