China is using soft power through the form of foreign aid to help the world, despite criticism from the West that its approach lacks transparency.

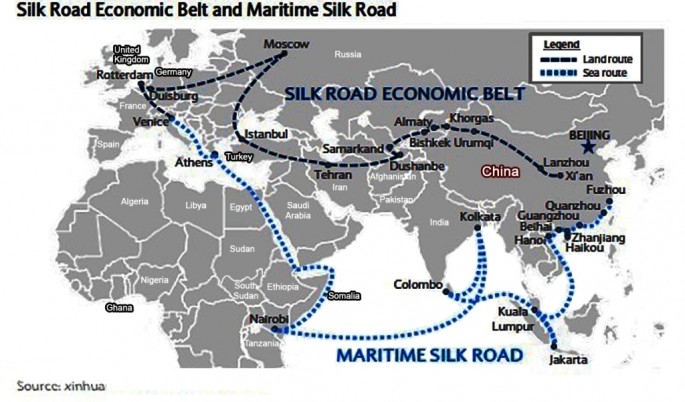

There is no better proof of this than the Silk Road Economic Belt and the 21st Century Maritime Silk Road initiatives, the latest strategies under Beijing's foreign aid policy.

From Jan. 2014 to March this year, around 76 percent of the loans the Chinese government granted were to countries included in the trade and infrastructure projects meant to link China and Europe.

Beijing's approach to offering loans, financial aid and infrastructure deals in exchange for natural resources has, despite spurring criticisms, also been compared to the Marshall Plan spearheaded by the U.S. after the Second World War.

The success of the resource-focused approach is best exemplified by Angola, where China has secured stable sources of crude oil and the rights to half of the oil wells in the country. Chinese companies and products are now found across Angola, where trade between the two countries has surpassed $37 billion in the past year alone.

Senior Chinese officials have been visiting Russia and Central and South Asian nations, negotiating high speed rail and nuclear power plant deals reaching more than 4 trillion yuan ($645 billion) as well as helping Chinese firms expand overseas.

The Silk Road initiatives, along with the China-led Asian Infrastructure Investment Bank (AIIB), will enable China to tap into its foreign reserves of over $4 trillion--mostly U.S. dollar-denominated assets--and reduce the influence of the greenback over the renminbi.

In addition, the Silk Road projects and the AIIB will allow Beijing to enter more currency swap and settlement deals with other nations, which in turn will create conditions for the yuan to grow into a global currency.

However, Beijing needs to start planning for the potential risks associated with the loans it is making under the Silk Road initiatives, given the political and cultural environment in the countries between China and Europe.