Cupertino Mayor Barry Chang is not impressed with Apple Inc., as the company allegedly evades taxes and hides profits in offshore account. The iPhone maker, the world's most valuable corporation and Cupertino's biggest and most economically flush resident has not impressed the mayor of its hometown.

Apple's practices are leaving Cupertino overcrowded. The city homes the computing firm's current headquarters and 2.8 million-square-foot "Spaceship" campus.

"They're making profit, and they should share the responsibility for our city," Chang told The Guardian. "But they won't."

Apple pays about 2.3 percent tax rate, paying Cupertino $9.2 million from 2012 to 2013 despite housing about $181 billion overseas. If not of system loopholes, Apple would owe around $59.2 billion in taxes.

The Cupertino mayor is stuck between Cupertino citizens who are frustrated with overcrowded roads and Apple not paying his infrastructure proposal. He believes the tech giant should pay more and tried to demand $100 million from it for the city's infrastructure projects.

However, the motion was struck down by the city council. Chang is determined not to back down.

"We are the center of technology, and our public transit system is old and embarrassing," Chang told the online newspaper. He described the local officials as having no backbone because "they get scared."

Chang who has been the city mayor since December 2015 had approached Apple three years ago when he was city councillor. However, he left when advised he could not come in. He had not gone back after that.

The computing firm said it pays Cupertino tens of millions of dollars in additional property and sales taxes, and because it is constructing its new campus. It will generate billions to local businesses upon the completion of the new building.

The current tax law in the United States allows practices, such as the "double Irish." Companies like Apple can build headquarters in low-tax countries like Ireland and channel profits to subsidiaries in tax havens, such as Bermuda or Cayman Islands.

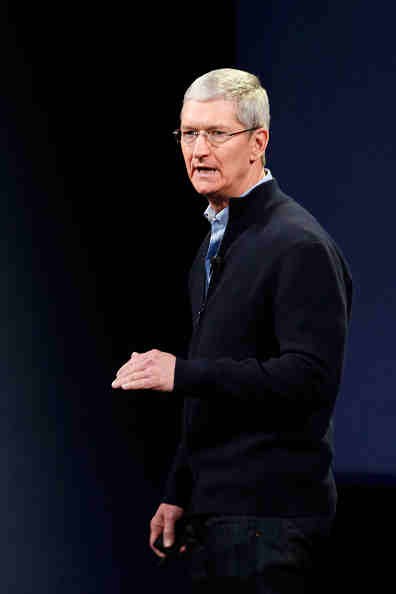

Criticism of Apple's tax practices is "total political crap," Apple CEO Tim Cook told Charlie Rose in an interview with "60 minutes" in December. He said the U.S. tax code should be modified to let companies bring profits home without paying 35 to 40 percent tax rate, which they consider exorbitant, The Verge reported.

The video below has Cupertino Mayor Chang discussing that Apple must pay more taxes.