China's colossal mountain of government-generated debt -- and a discomfiting recent rise in corporate debt -- threatens to trigger a full-scale banking crisis that might engulf the world, warned the Bank for International Settlements (BIS), the world's "bank for central banks" based in Switzerland.

BIS said in its quarterly report that China's "credit to GDP gap" has reached 30.1, its highest to date. The gap is also the highest compared to any other major country tracked by the BIS. Any score above 10 requires careful monitoring based on analysis of data from banking crises around the world over the past 60 years.

BIS noted the gap is also much higher than the scores in East Asia's speculative boom on 1997 or in the U.S. subprime bubble before the Lehman crisis. The credit to GDP gap measures deviations from normal patterns within one country and strips out cultural differences.

China's failure to curb excesses in its credit system despite pledges to curb its addiction to debt-driven growth has unleashed a mammoth crisis it might not be able to contain -- again by issuing more debt.

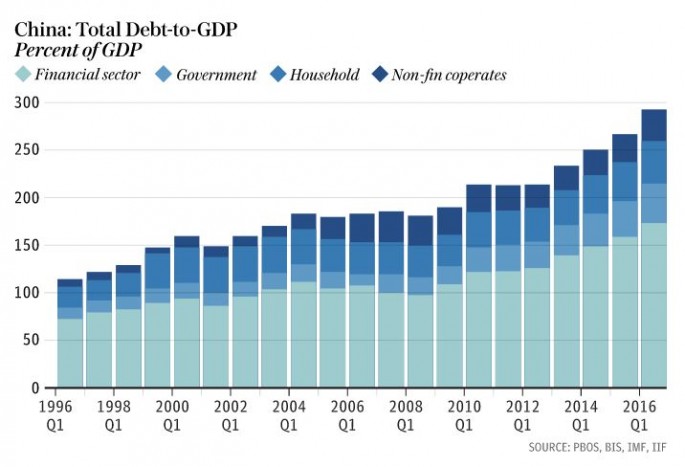

China's total credit reached 255 percent of GDP in 2015, a jump of 107 percentage points over eight years. This is a very high level for a developing economy. Ominously, this level keeps rising at a rapid rate.

China's outstanding loans have reached $28 trillion, almost equal to the debt in the commercial banking systems of the US and Japan combined. Its debt alone has reached 171 percent of GDP, another terrifying signal that doom might be around the corner.

BIS warned the scale of this debt is enough to threaten a worldwide shock if China's financial system spirals out of control.

Because of this imminent danger from China, BIS said there is enough reason to worry about the health of world's financial system.

"There has been a distinctly mixed feel to the recent rally -- more stick than carrot, more push than pull," said Claudio Borio, BIS chief economist.

"This explains the nagging question of whether market prices fully reflect the risks ahead."

Some analysts contend that China must recapitalize its banks because of bad loans that are likely higher than the official numbers released to the world.