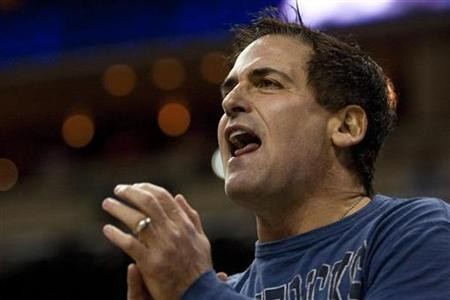

Multi-billionaire Mark Cuban, investor and owner of the Dallas Mavericks, made his fortune during the late 1990s' dot-com explosion when he founded and then sold Broadcast.com for over $5 billion. However, on his March 4 blog, Cuban warned that there is more investment now in no liquidity public Internet websites than during the 2000 tech bubble.

Cuban basically argues that the 2000 tech bubble involved public stocks, but today's bubble involves private investment. The result is that "angel investors" cannot liquidate their investments if the private companies they invested in experience financial trouble. America has approximately 225,000 angel investors.

In his blog Cuban argues that such angel investors are now "under water," according to Bloomberg. In fact, he has "no doubt" about this fact.

Cuban explains that the problem is a market that has no valuations and also no liquidity. When a company has no buyer for its stocks, those stocks are worthless.

In part Cuban seems to be referring to the over two million apps sold in app stores. However, some experts argue that the apps are unrelated to a true tech bubble, since the maximum average start-up funds needed for a new app ($700,000) is higher than the average angel investment in the U.S.

Cuban seems to think that private investors' investments in small tech companies and apps are unwise, according to BGR. However, it also notes that Nasdaq's valuation is not nearly as high as it was in the 2000s; today the number of highly-valued companies is significantly lower than then.

Some tech experts have also argued that Cuban's own business past refutes his argument that today's tech bubble is worse than in 2000. When he sold his company I 1999, it was earning $13 million per quarter; meanwhile, some of today's apps generate that figure in one month!