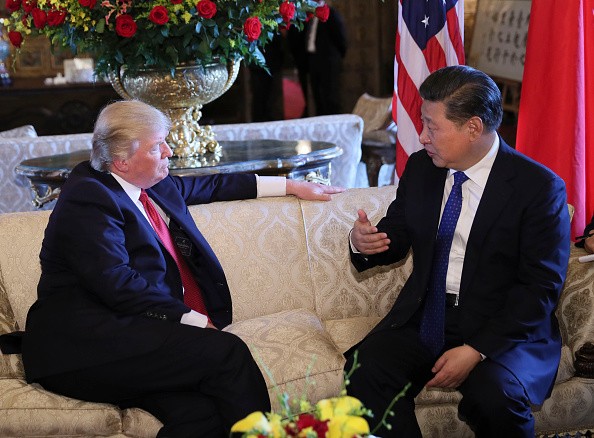

U.S. tech giants, such as Google, are anticipating the outcome of the Florida meeting between Chinese President Xi Jinping and U.S. President Donald Trump held in Mar-a-Lago on April 5 to 6, TheStreet.com reported.

According to a senior Chinese official, if the Xi-Trump meeting does not succeed, Google may find it difficult to re-enter the Chinese market.

Although Google ceased its operation in China in 2010 after a disagreement with the Chinese government over censorship policies, it is now working to unblock the business in the country.

"China's relationship [with Google] is improving, and both sides' leaders have met on several different occasions," senior parliamentarian Liu Binjie said.

Liu, however, said that Google's return to China would still depend on the Chinese-U.S. relations, considering that Trump had said severe things about China several times, especially its trade policy.

Prior to the talks, Trump had tweeted that the meeting will be a "very difficult" one, as he had believed that the trade deficits and job losses that the U.S. incurred were due to its trade relations with China.

Predictions

Pete Cohn, an analyst for Height Securities said that the U.S. is open to China and it is willing to buy Chinese products. As China became an export-driven economy, many countries, including the U.S., have been interested in making a presence in the Chinese market.

Cohn said that the two countries may discuss the rebalancing of their trade relationship. This means China may have to open its markets more and lift the block on U.S. exports to allow U.S. goods in its market.

The analyst also predicted that Xi will most likely work out to open its market to U.S. goods.

"This is really an opportunity for the two leaders to exchange views on each other's respective priorities and to chart a way forward for the U.S.-China bilateral relationship . . . President Trump really views this meeting as a first step toward building a constructive and a results-oriented relationship that's going to deliver benefits to both countries," a White House official said in a press briefing on Wednesday, April 5.

It is also expected that the meeting will touch on the role of the Committee on Foreign Investment in the U.S. (CFIUS), in reviewing foreign takeovers, which Trump may use as a bargaining tool.

According to Cohn, Trump may ask Xi to accommodate U.S. companies that wanted to expand in China if he wants Chinese companies to buy more U.S. companies and assets.

Currently, there are deals pending with CFIUS, which include the acquisition of Lattice Semiconductors (LSCC) by Canyon Bridge, the Stillwater Mining (SWC)-Sibanye Gold acquisition and Ant Financial's acquisition of MoneyGram (MGI), among others.

Repercussions

U.S. tech companies have closely monitored the meeting as they are concerned about whether Trump would make good on his threat to impose a 45 percent tariff on all Chinese goods, which would impact not only on China but also on their ability to gain share in the Chinese market.

"There's a lot at stake for tech companies," Daniel J. Ikenson, director of Cato's Herbert A. Stiefel Center for Trade Policy Studies, said. "If bad blood comes between the two leaders, then the way a proxy war would be handled would be to go after the other country's most important companies by reducing access to important markets."

According to Ikenson, the U.S. tech companies that may be affected most by hostility with China are big companies such as Alphabet's Google, Cisco, Intel, Oracle, Tesla, Western Digital and Nvidia because they have the most to lose from damaged relations between the countries.

Conversely, if the China-U.S. relation warms up, Alibaba could do more in the U.S. markets, competing more with its rival Amazon, Ikenson said.

The U.S. chip sector is also worried about the trade tariff as more than three-quarters of its exports are sent to Asia. SEMI senior director of North American public policy Jamie Girard said that SEMI, which has 2,000 member companies in the semiconductor sector and other related industries, is "very concerned about the tone on trade seen during the election and from the new administration in the past few months."

In addition to this, tech companies are also anticipating the Trump administration to push for the protection of intellectual property rights as this would prevent their products from being pirated and sold at lower cost in China.

Another issue that tech companies expect to be discussed during the meeting is the new cybersecurity law that China has passed, which will take effect in June. This will require U.S. tech companies to provide the Chinese government with proprietary source code on their products to ensure that they cannot be breached or hacked.