The intense price war had brought China's leading mobile chip manufacturers at a struggle to keep their margins and net incomes at a reasonable level, leading to consolidation in the sector, as reported by Shanghai's China Business News.

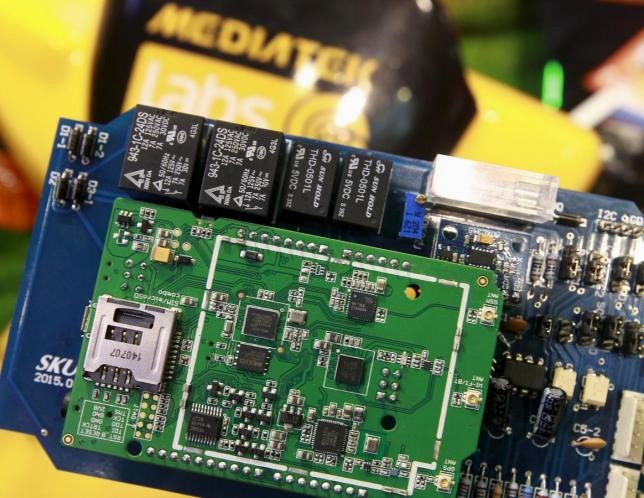

During a report on second-quarter performance, Taiwan-based chip supplier MediaTek revealed a sales drop of 13 percent year-on-year and a 49.2-percent decline in net income.

On the other hand, U.S.-based Qualcomm's sales dropped 14 percent, while its net profits crashed by 47 percent on the third quarter of its fiscal year, according to the paper.

The Chinese corporation Spreadtrum Communications also had low estimates on its gross profit margins in spite of an expected sales growth of 20 percent, the report added.

A source familiar with the industry had shared that Qualcomm's reduced sales were a result of the decreased orders for its high-quality chips, which can be attributed to the fact that Samsung preferred to use its proprietary processor Exynos for its top Galaxy S6 lineups.

"Samsung's orders had a great impact on Qualcomm. Qualcomm turned to target market shares of MediaTek because of the loss of orders and engage in a heated price war," stated Wang Yahui, Mobile China Alliance's secretary-general.

MediaTek and Spreadtrum had no choice but to join Qualcomm's price cuts, the source said.

"Prices of LTE mobile phone solutions have dropped to an extreme low level of just over 6 yuan ($0.97). With no significant reduction of operating costs, the lower price led to declining margin and net profits," Wang said.

Over the previous three quarters, Qualcomm has noticed its net profits and margins go down more than 27 percent. MediaTek suffered its lowest profits, which amounted to NT$6.38 billion ($201 million) during its second quarter, according to the report.

After overtaking MediaTek's leadership in 3G chips, Wang said that Spreadtrum would be aggressively competing for greater market shares toward the end of this year, followed by the 6 billion yuan investment ($970 million) from Intel via its mother company, Tsinghua Unigroup.

Wang also predicted continued consolidations in the chip industry, as Intel apparently bought VIA Telecom for its CDMA2000 wireless technology. He added that Marvell, the American chip manufacturer, would likely be out of the market.

Qualcomm still has a high chance of regaining orders from the South Korean company Samsung to be used with its Galaxy S7 model next year, Wang said.

Chip suppliers are expected to observe the rise of handset manufacturers creating their own chips for their devices, the paper said.

Huawei has started utilizing its in-house chips supplied by its own corporation, Hisilicon, in a few of its high-end models. Xiaomi is also expected to follow the trend and use its proprietary chips in low-end Redmi phones from 2016, the report said.