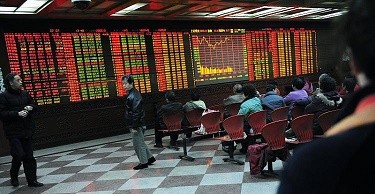

Jittery investors worried over the slowdown in the Chinese economy caused sell offs in many markets, resulting in the worst week for U.S. stocks.

This caused the Dow Jones industrial average to drop by 3.12 percent or 530.81 points to 15,459.88 on Friday. The S&P 500 shed 3.18 percent or 64.7 points to 1,971.03, while the Nasdaq Composite went down 3.52 percent of 171.45 points to 4,705.04, reports Globe & Mail.

Taking into account the losses during the first four days of the week, Bloomberg estimates that investors lost $2.2 trillion wiped out from the value of global stocks. Even the five companies that are considered the Fab Five, made up of Netflix, Facebook, Amazon, Google and Apple, suffered sells-off, resulting in $97 billion in market value erased over the past two days.

European and Asian stocks behaved similarly with the Stoxx Europe 600 Index dipping 6.7 percent in the last three days, the worst decline since September 2011. UK's FTSE 100 fell 1.2 percent, DAX in Germany suffered its worst month since 2011 with a 1.4 decline and France's CAC 40 went down by 1.1 percent.

The decimation in the market did not surprise Wedbush Securities Managing Director of Equity Trading Michael James who explains, "You typically tend to have a follow-through after big days. Given we broke below just about all key short-term technical levels, it isn't surprising to see us down again today."

In the coming days, all eyes will remain in China if financial authorities would provide further policy support steps, including how the Bank of China would handle the yuan and trading swings, according to Investec Economics analysts' note to clients.

BGC Partners market strategist Michael Ingram adds, "This market won't have legs until we have further clarity on the Chinese currency and U.S. rates. He foresees question over growth lingering, causing investors to be scared and confused, while emerging market equity investors are "probably close to suicidal."