Chinese home appliance maker Midea Group made an offer on Wednesday to buy German factory robot manufacturer Kuka AG, in the latest attempt by a Chinese investor to acquire cutting-edge industrial technology crucial for China’s ambitions to become a high-end manufacturing powerhouse.

The 115-euro-per-share offer values Kuka at around 4.5 billion euros ($5.07 billion) and represents a premium of 36 percent to Kuka's share price of 84.41 euros at close on Tuesday, according to Reuters. Shares in Kuka rose by more than 30 percent on the news.

A Midea spokesperson told The Wall Street Journal on Wednesday that the firm intends to keep the company listed and has no plans for a complete takeover. However, since the company is seeking a stake of more than 30 percent, it is required to make an offer for all outstanding shares.

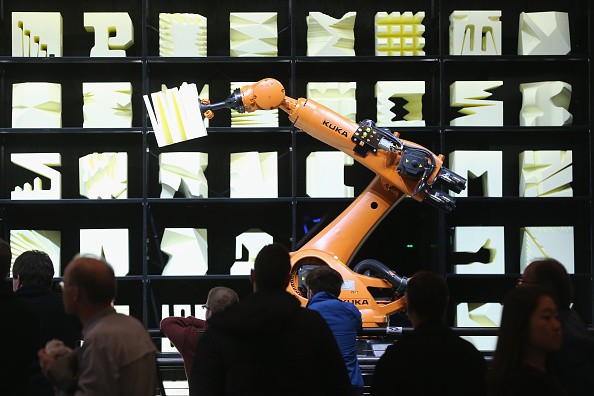

Based in the southern Bavarian city of Augsburg, Kuka is one of the world's largest producers of industrial robots and a symbol of post-war Germany's drive to upgrade its manufacturing sector to master the industrial Internet.

The deal also marks the latest in a series of German industrial groups to be targeted by Chinese buyers as China's burgeoning economy attempts to shift from a low-cost factory location to a high-tech industrial hub.

"KUKA is in excellent condition today and we are committed to investing in KUKA's employees, brand, intellectual property and facilities to further support the company's development," Midea Chairman and Chief Executive Paul Fang said in a statement.

Midea said it aims to expand Kuka's know-how in robotics for general industry and logistics and provide better access to Chinese markets.

"One of the leading rationales for the deal is rising labor costs. This means efficiency becomes more important for growing our business and for the Chinese economy as a whole," said Andy Gu, vice president for Midea's international business.

"We want to keep Kuka's separate identity as a German company," he added. "Where we can help Kuka is mostly in China. Kuka management has plans to grow in China. Given our meaningful footprint in China, we can help them accelerate growth in terms of our customer base and supply chain."

An ally of German Chancellor Angela Merkel said Berlin will not intervene in the purchase, as German companies are also investing in Chinese and other foreign companies.

"We live in a free market economy and expose ourselves to global competition," said Michael Fuchs, deputy leader of Merkel's CDU/CSU parliamentary group in Germany's lower house.

In terms of direct investment in property, plants and equipment, Germany's private sector has invested nearly 60 billion euros in China, dwarfing the 2 billion euros that Chinese firms spent in Germany, according to the Association of German Chambers of Commerce and Industry.

Jost Wuebbecke of Berlin-based think tank Merics said Chinese foreign direct investment in Germany is welcome in principle, but Kuka is an exception because of its role in the country's industrial sector.

"From a German point of view it's not necessarily an advantage to share the technology because of Germany's very considerable lead in this area," Wuebbecke said.