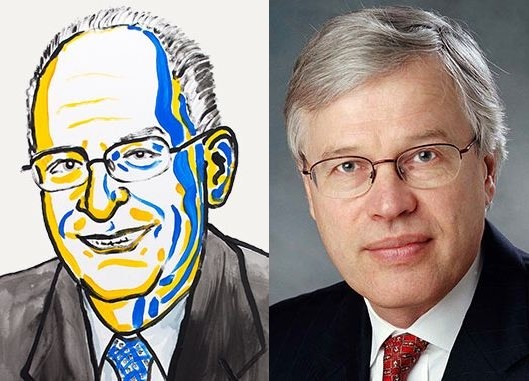

The Nobel Memorial Prize in Economic Sciences (2016) has been awarded to Oliver Hart at Harvard University in Massachusetts and Bengt Holmström at the Massachusetts Institute of Technology "for their contributions to contract theory."

The Royal Swedish Academy of Sciences said the "new theoretical tools created by Hart and Holmström are valuable to the understanding of real-life contracts and institutions, as well as potential pitfalls in contract design."

It said this year's laureates "have developed contract theory, a comprehensive framework for analyzing many diverse issues in contractual design, like performance-based pay for top executives, deductibles and co-pays in insurance, and the privatization of public-sector activities."

The academy also noted that through their initial contributions, "Hart and Holmström launched contract theory as a fertile field of basic research.

"Over the last few decades, they have also explored many of its applications. Their analysis of optimal contractual arrangements lays an intellectual foundation for designing policies and institutions in many areas, from bankruptcy legislation to political constitutions."

Hart, 68, is an expert on contract theory, theory of the firm, corporate finance and law and economics. His research centers on the roles that ownership structure and contractual arrangements play in the governance and boundaries of corporations.

He has used his theoretical work on firms in two legal cases as a government expert (Black and Decker v. U.S.A. and WFC Holdings Corp. (Wells Fargo) v. U.S.A.).

Holmström, 67, is well known for his work on principal-agent theory. More specifically, he has worked on the theory of contracting and incentives, especially as applied to the theory of the firm, to corporate governance and to liquidity problems in financial crises.

The academy explained that society's many contractual relationships typically entail conflicts of interest. Contracts, therefore, must be properly designed to ensure the parties take mutually beneficial decisions.

In the late 1970s, Holmström demonstrated how a principal (e.g., a company's shareholders) should design an optimal contract for an agent (the company's CEO), whose action is partly unobserved by the principal.

Holmström's "informativeness principle" stated precisely how this contract should link the agent's pay to performance-relevant information.

Using the basic principal-agent model, he showed how the optimal contract carefully weighs risks against incentives. In later work, Holmström generalized these results to more realistic settings, namely when employees are not only rewarded with pay, but also with potential promotion; when agents expend effort on many tasks, while principals observe only some dimensions of performance and when individual members of a team can free-ride on the efforts of others.

In the mid-1980s, Hart made fundamental contributions to a new branch of contract theory that deals with the important case of incomplete contracts.

Because it is impossible for a contract to specify every eventuality, this branch of the theory spells out optimal allocations of control rights: which party to the contract should be entitled to make decisions in which circumstances?

Hart's findings on incomplete contracts have shed new light on the ownership and control of businesses and have had a vast impact on several fields of economics, as well as political science and law.

His research provides us with new theoretical tools for studying questions such as which kinds of companies should merge, the proper mix of debt and equity financing, and when institutions such as schools or prisons ought to be privately or publicly owned.